USING DEPOSIT BONDS FOR PROPERTY INVESTMENT

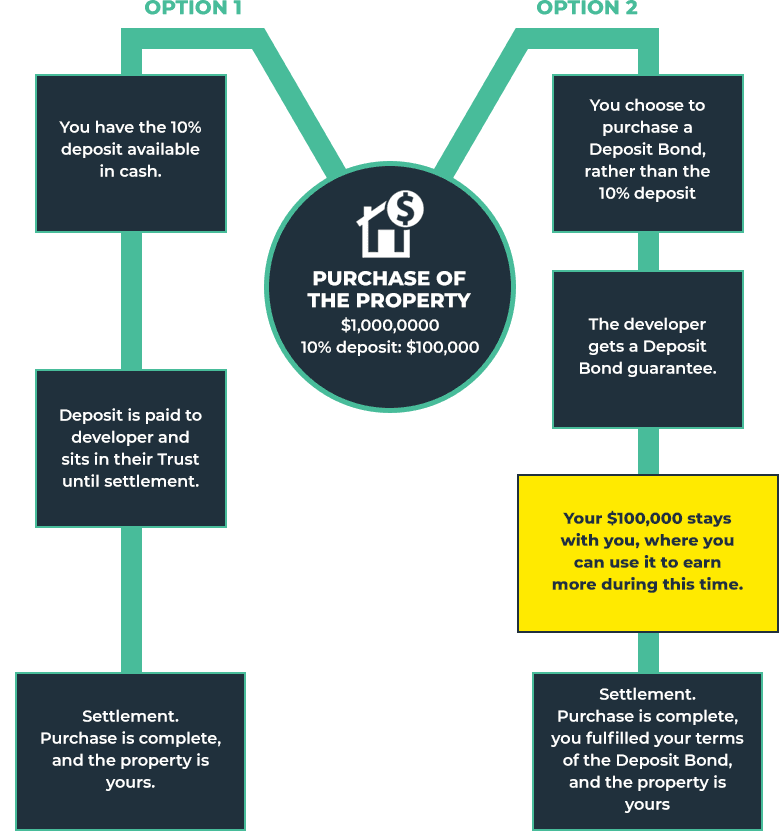

Deposit Bonds are a smart, viable solution when purchasing an investment property, without needing to free up the cash for 10% deposit.

There a multiple reasons why buyers may prefer to use Deposit Bonds instead of the actual deposits for a property or investment:

A Deposit Bond is an insurance policy. The deposit is guaranteed by the insurance company to the vendor (in property cases, this is the developer).

No money actually changes hands under the Deposit Bond. Instead, the purchase funds are paid in full at the time of the settlement. At that time, the terms of the bond are complete, the vendor receives the deposit with the transfer of the purchase funds.

- Loan funds for the purchase may only be available at settlement

- A buyer may also be selling simultaneously and is waiting for the sale funds to arrive

- Assets or cash may be tied up, or simply not available

- Savvy investors see Deposit Bonds as an efficient use of capital, rather than having a deposit sit in a trust for 2-3 years, they could use their cash elsewhere and earn higher returns

HOW DO DEPOSIT BONDS WORK?

When are Deposit Bonds Used?

When purchasing a property, it is very common for the buyers to not have the 10% cash deposit, or choose to not pay it. In these instances, Deposit Bonds are a viable substitute for the deposit, widely accepted by developers to guarantee the deposit will be paid at the time of settlement.

Deposit Bonds are most often used when:

- Property buyers are selling simultaneously

- There is a limited amount of liquid cash available at the time of the purchase Financing funds will only be available at the time of settlement

- The purchaser prefers the amount of the deposit to be better used elsewhere, in

- accounts that earn higher rates of return.

Benefits of using Deposit Bonds?

There are a number of benefits to using Deposit Bonds, rather than paying the deposit to developers.

- Purchasers can avoid costly time delays of freeing up cash or bridging finance

- Purchasers’ savings remain intact in an account that is earning a higher rate of return

- Deposit Bonds are available for short and long terms

- Deposit bonds are widely accepted and can even be used at property auctions

- The period between deposit and settlement can often take 2-3 years, and many investors prefer to keep or use their cash elsewhere.

“Deposit bonds are an efficient use of money. When you pay a deposit, the developer will keep it in a trust. Why tie up that $100,000 for 2-3 years, when you can secure a $1,000,000 property for $15,000?”

- Matt Sully, APFG CEO -

FAQ's

A deposit bond is a financial guarantee issued by an insurance company. It’s used to secure funds required for the deposit on a residential or commercial property purchase, while you wait for your own money to be available. Deposit bonds are commonly used by home buyers, real estate agents and solicitors as security when buying or selling properties. They also provide benefits over other forms of deposit guarantees such as cash deposits that may not be readily available at the time of purchase, bank cheques which can take five business days to clear, and holding deposits which incur potentially high interest costs if held beyond a certain period of time. It’s important to note that deposit bonds are not always accepted by all property sellers, especially for new projects as builders and developers are required to earn a certain level of cash flow throughout the construction phase. Bonds are usually valid until the time of the settlement, but it is recommended to be sure on the terms and length of the bond before purchasing.

- No need to liquidate funds. This allows investors to keep their money available in case they find another investment opportunity, where there is better return than the accrued interest from the deposit. Using deposit bonds allow for investors to increase their portfolio, without the need for large sums of liquid cash for deposits. - Security. The security offered by a deposit bond gives peace of mind for the investor, recipient or property developer as well as the vendor. Investors are required to have a certain level of equity when applying for or requesting a bond. Developers are ensured to have a qualified buyer for their asset or unit. In the case of default on the deposit, the developer can make a claim to the insurance company or vendor for the remainder of the deposit. - Convenience. Deposit bonds are easy to organise, with the ability to provide one within a few hours. This makes them ideal for property investors who need the deposit quickly and don't want to liquidate assets or borrow from lending institutions. It should be noted that the investor will need to prove a certain level of equity in order to secure the bond. - Cost saving. Deposit bonds cost a fraction of the deposit, often around 10-15% of the total deposit amount, with few upfront fees and charges, which means you can secure your investment without spending any capital immediately. The deposit bond is paid before settlement on your new property using funds that would have been used towards the deposit anyway, so it's not an additional expense (or risk). It just simplifies things by allowing you pay after settlement rather than having cash available now.

Deposit bonds are legal documents, widely accepted across Australia. No money is actually exchanged when using Deposit Bonds, but property developers are happy to accept the bonds as the guarantee for the purchase. Should the purchase fall through before the time of settlement, the developer can claim the amount of the deposit from the insurer. Deposit Bonds are favorable options for buying off-the-plan, when purchases are made before the property is complete, and build or completion could take years. Talk to an APFG manager about our off-the-plan projects, whose developers gladly accept Deposit Bonds.

A Deposit Bond is a smart, viable option for a number of situations or reasons. Most commonly, deposits bonds are used when: - The property is off-the-plan. Talk to an APFG property agent to find out which of our projects are accepting Deposit Bonds. - The purchaser is also selling, or waiting for funds to come through another source. - The purchaser would prefer to keep the cash, where he/she can use it to earn a higher return. - The purchaser has equity in homes and properties, but a limited amount of liquid assets.

Deposit Bonds are available to individuals, companies and trusts. They are most suitable for existing property owners and investors who wish to purchase another property to expand their portfolio.

Like any insurance policy or credit loan, the insurance company will determine if the purchaser is qualified for the amount of the policy. In the case of Deposit Bonds, you have to apply and meet financial criteria and must have a certain amount of equity to ensure that there is minimal risk that you will fail or default on the settlement.

This is determined between the purchaser and the insurance company, depending on when the developer needs the payment of the deposit or settlement.

If the purchase does not go through and the purchaser defaults on the agreement, the developer can claim the amount of the bond (the 10% deposit) from the bond issuer. After that is settled, the insurance company will recover the amount from the purchaser.

GET STARTED

ACN 650 427 884

Level 10 36 Marine Parade Southport QLD 4215

© 2026 APFG. All Rights Reserved. Powered by geonet.me