FOREIGN INVESTOR LOAN

KEY FEATURES

New Purchase, Refinance or Equity Release

Multilingual Customer Service

Confirmation of Loan Acceptance within 48 hours

Fully Featured Online Access

Salaried & Self Employed Applicants

Up to 75% LVR

PRODUCT OVERVIEW

| Minimum Loan Amount | AUD $150,000 |

| Maximum Loan Amount | AUD $1,500,000 for Melbourne and Sydney Metro |

| AUD $900,000 for Brisbane, Gold Coast, Canberra, Perth and Adelaide | |

| AUD $2,000,000 for single borrower | |

| AUD $500,000 for non metro | |

| AUD $1,000,000 and LVR ≤65% >0.30% p.a. loading to the applicable rate for clients with loan amount > AUD $1,000,000 and LVR ≤65% | |

| 0.50% p.a. loading to the applicable rate for clients with loan amount > AUD $1,000,000 and LVR >65% | |

| Variable Interest Rate | 3.88% p.a. for clients with LVR ≤ 65%, 4.28% p.a. for clients with LVR > 65% to ≤ 70%, 4.98% p.a. |

| for clients with LVR >70% | |

| Alt Doc Premium | 0.50% p.a. loading to the applicable rate for clients with loan LVR ≤65% |

| 0.70% p.a. loading to the applicable rate for clients with loan LVR >65% | |

| Interest Only Premium | 0.30% p.a loading to the applicable rate |

| Loan Term | Up to 30 years (Maximum 5 year Interest Only) |

| Borrower Type | Salaried Employee and Self Employed |

| Security Size Requirements | No minimum size (refer to internal area) <45 sqm: max 50% LVR, |

| 45 – 50 sqm: max 60% LVR, >50 sqm: max 75% LVR | |

| Monthly Repayments | |

| Repayment Type Security | 1st Mortgage Property Security |

FEES & CHARGES

| Conditional Offer | Application Fee | $990[4] |

| Settlement | Legal Fee | $400 plus disbursements |

| Annual | Annual Package Fee | $499[5] |

| On Final Repayment of Loan | Mortgage Discharge Fee | $550 |

DOCUMENT CHECKLIST

SALARY AND WAGE EARNERS (PAYG)

Last 3 months personal bank account statements showing regular salary credits; and

Employment agreement or letter from Employer; or

Last 3 months salary slips for regular income.

SELF EMPLOYED

Last 6 months personal bank account statements showing distributions, dividends or other credits from the business (business bank statements may be required if credits are irregular or insufficient); and

Two years business financials; or

Accountant certificate.

ALL APPLICANTS

Completed Mortgageport Application Form;

Identification:

Copy of Passport, and

Copy of one other Photo ID;

Country Identification Card; or

Driver’s Licence;

Personal Credit Check Report issued by relevant jurisdiction[6]

Evidence of assets where income is assessed for serviceability, including:

Property Ownership;

Share/Investment Certificates/Statements;

Rental Statements;

Purchase:

Evidence of funds to complete the property purchase; and

ii. Contract of sale;

Refinance and/or Equity Release:

6 months mortgage statement (for property under mortgage); and/or

Copy of the property title (for fully owned property applying for equity release)

All languages other than Chinese, Vietnamese, Bahasa Indonesia and Bahasa Malaysian documents must be translated by a qualified NAATI Translator.

IMPORTANTS

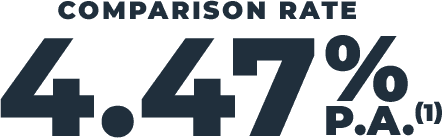

The Comparison Rate is based on a secured loan amount of AUD $150,000 at 60% LVR, and salaried applicant purchasing a property larger than 50sqm, over a term of 25 years. Warning: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. This advertisement does not take into account your personal and financial situation. Terms, conditions, fees, charges and lending criteria apply and are available on application.

The variable interest rate is calculated by reference to the variable interest rate plus or minus an Applicable Margin.

Other fees and charges are payable.

Includes one valuation up to $440. Where valuation exceeds this cost, the difference is payable by the client at settlement.

The annual package fee for Year 1 is payable at settlement and on the annual settlement anniversary thereafter.

Acceptable personal credit check reports are ones issued by: China (Mainland): Credit Reference Centre, People’s Bank of China, Indonesia: Bank of Indonesia, Malaysia: Bank Negara Malaysia, Singapore: DP Bureau. For countries not listed here, our loan assessors will advise on an acceptable credit reporting agency in your country at the time of loan assessment.

DISCLAIMER: This document is not an offer of finance to any person and the delivery of this document to any person does not constitute an offer of finance that can be relied on. Any finance that may be provided by us to you will only be considered after we have received the required information from you and have conducted our own checks and assessments. We reserve the right to refuse finance to any person for whatever reason in our absolute discretion. Should there be any inconsistency between the English and the Chinese versions, the English version shall prevail. PRIVACY: In the event that AUSTRALIAN PROPERTY AND FINANCE GROUP PTY LTD collects any private information from you then we will deal with that information in accordance with our Privacy Policy.

GET STARTED

ACN 650 427 884

Level 10 36 Marine Parade Southport QLD 4215

© 2026 APFG. All Rights Reserved. Powered by geonet.me